How Public Adjusters Make The Flood Recovery Process Convenient?

When a river overflows, a claim for flooding develops. This happens when the banks of the river become too high and the water begins to flow over them. The flooding can cause significant damage to property and can even lead to fatalities. In order to file a flood claim, individuals must have proof of damage and loss. They may also need to provide documentation of how high the river was at the time of the overflow. Flooding is a common occurrence in many parts of the world. When a river overflows its banks, it can cause significant damage to homes, businesses, and other property. Numerous sizes, scopes, and effects on the neighborhood are possible. Flooding cannot be prevented. These natural hazards are brought on by the flow of additional water near river banks during periods of prolonged rain. Water is flowing rapidly through streams and across the ground. A defective door or roof might potentially allow rainwater to enter a structure. It is common in river systems, where marine waves meet river flows, together with storms and tidal surges. Property damage from flooding can be quite severe. Insurance adjusters make sure you receive the best compensation possible while taking the hazards connected to the property into consideration. A public adjuster from Chicago will improve the efficiency of your insurance claim and lessen the stress and financial burden caused by your disaster.

The term flood claim refers to a legal claim filed against someone else after a natural disaster such as flooding, tornadoes, or lightning strikes. If a hurricane swept down any particular street, residents living in flood zones could make a legal claim on their property. Customers know how much they’ll get based on their insurance coverage and how much damage floods can cause across a city by the time their claim is processed.

How Do Flood Insurance Claims Perform?

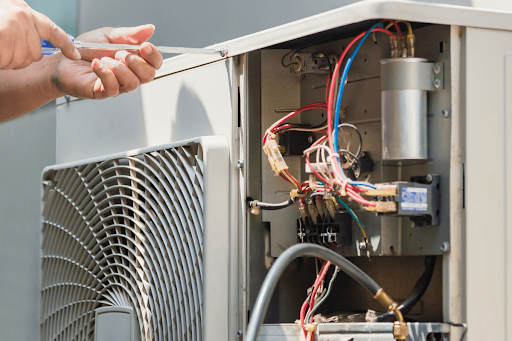

Weather events like droughts and flooding seriously injured individuals. You could experience severe mental and financial stress even after a major catastrophe. Your shoulders drop as a result of the emotional anxiety you experience when insurance companies refuse to cover you. It can be exhausting for those in need when the traditional rescue effort is carried out so quickly by organizations with ties that go beyond reduced people who operate at a slower pace. In the immediate aftermath of a calamity, time, money, and emotional energy are required to recover. While this trying period is underway, corporations and individuals have several options for separating. Assisting people to recover from natural disasters and return to their regular lives is the business of public adjusters. In addition to property damage and fire damage, public adjusters also cover water damage and other costs not covered by insurance.

What Assistance Will Public Adjusters Provide You Throughout These Hard Times?

In these uncertain times, insurance adjusters make the procedure of filing a compensation claim tolerable and feasible. It’s critical to have access to an impartial adjuster who can explain what you truly want to learn about your disagreement as soon as possible when a people’s home is ravaged by a fire or a disaster. An invaluable support network is offered during these trying times by insurance adjusters. Insurance adjusters step in to aid when insurance coverage falls short of covering everything. If your home has been ruined, you should hire experienced adjusters so that you can maximize the value of your claim.

You might want to think about working with flood insurance adjusters if your insurance provider is having difficulties processing your claim and is unable to help you. In order to calculate the cost of damages or repair, flood financial penalties are unique in that they typically require a high level of verification and regularity. Adjusters for flood insurance may guide you through the procedure and give you advice on what you should know to have the best chance of surviving. Large storm insurance providers have a dedicated resolving disputes attorney assigned to them. Legal experts with a wealth of knowledge in handling claims, and flood assessors. If they are aware of your specific needs, they will undoubtedly offer you better service than your insurance provider. An insurance adjuster can evaluate the risk connected to the property as well as the level of responsibility for an incident. To determine whether a person is eligible for insurance, the adjuster looks at certain risk factors that could have an impact on them.